What Does Feie Calculator Do?

Table of ContentsFeie Calculator Can Be Fun For EveryoneHow Feie Calculator can Save You Time, Stress, and Money.Some Known Details About Feie Calculator The Ultimate Guide To Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.

Initially, he sold his united state home to establish his intent to live abroad completely and obtained a Mexican residency visa with his partner to aid accomplish the Bona Fide Residency Test. In addition, Neil safeguarded a lasting building lease in Mexico, with strategies to at some point acquire a home. "I currently have a six-month lease on a house in Mexico that I can extend an additional 6 months, with the intent to purchase a home down there." Neil directs out that purchasing residential property abroad can be testing without very first experiencing the place."It's something that individuals need to be really persistent about," he claims, and advises deportees to be careful of common mistakes, such as overstaying in the United state

Neil is careful to mindful to Stress and anxiety tax united state that "I'm not conducting any business any kind of Illinois. The U.S. is one of the few countries that taxes its people no matter of where they live, implying that also if an expat has no income from United state

tax returnTax obligation "The Foreign Tax Debt allows individuals working in high-tax countries like the UK to counter their U.S. tax liability by the quantity they have actually currently paid in tax obligations abroad," states Lewis.

The Definitive Guide for Feie Calculator

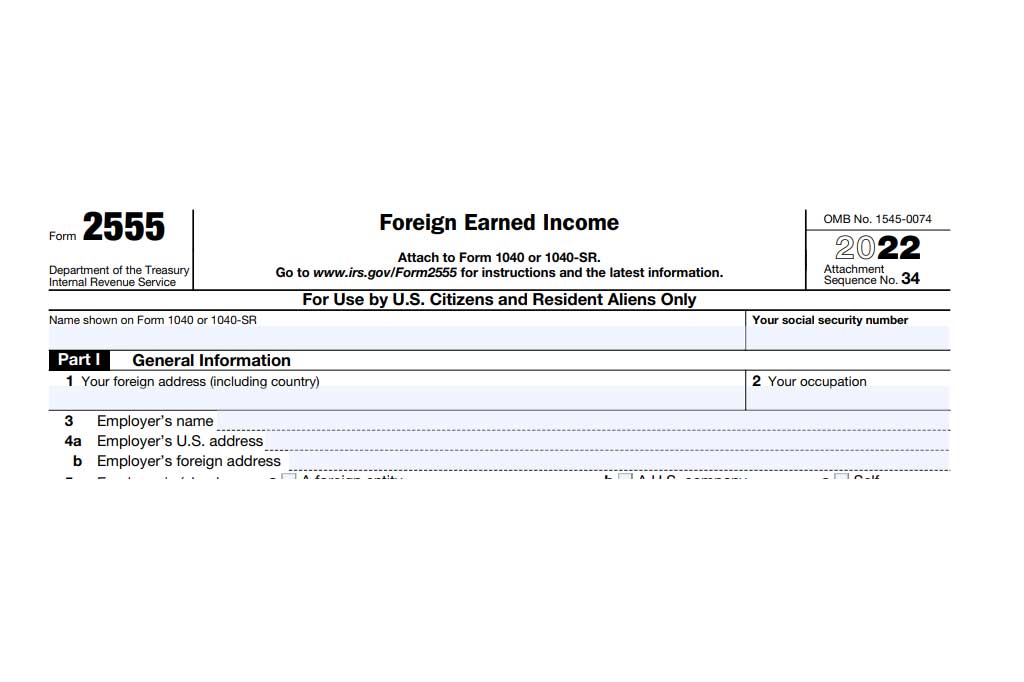

Below are a few of one of the most often asked questions regarding the FEIE and other exemptions The Foreign Earned Revenue Exclusion (FEIE) enables U.S. taxpayers to leave out up to $130,000 of foreign-earned earnings from federal earnings tax obligation, lowering their U.S. tax obligation. To get approved for visit our website FEIE, you should satisfy either the Physical Existence Examination (330 days abroad) or the Authentic House Test (prove your main home in an international nation for a whole tax obligation year).

The Physical Existence Examination needs you to be outside the united state for 330 days within a 12-month period. The Physical Presence Examination likewise calls for united state taxpayers to have both an international income and a foreign tax home. A tax home is defined as your prime location for company or employment, despite your family members's house.

3 Simple Techniques For Feie Calculator

A revenue tax obligation treaty in between the united state and one more country can assist avoid double taxation. While the Foreign Earned Income Exemption decreases gross income, a treaty may offer fringe benefits for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a required declare U.S. residents with over $10,000 in international financial accounts.

Qualification for FEIE relies on meeting particular residency or physical visibility tests. is a tax obligation expert on the Harness system and the creator of Chessis Tax obligation. He belongs to the National Organization of Enrolled Agents, the Texas Culture of Enrolled Representatives, and the Texas Culture of CPAs. He brings over a years of experience working for Huge 4 companies, encouraging migrants and high-net-worth individuals.

Neil Johnson, CPA, is a tax obligation expert on the Harness system and the creator of The Tax Dude. He has more than thirty years of experience and currently focuses on CFO services, equity compensation, copyright taxes, marijuana taxation and divorce relevant tax/financial preparation matters. He is a deportee based in Mexico - https://www.quora.com/profile/FEIE-Calculator.

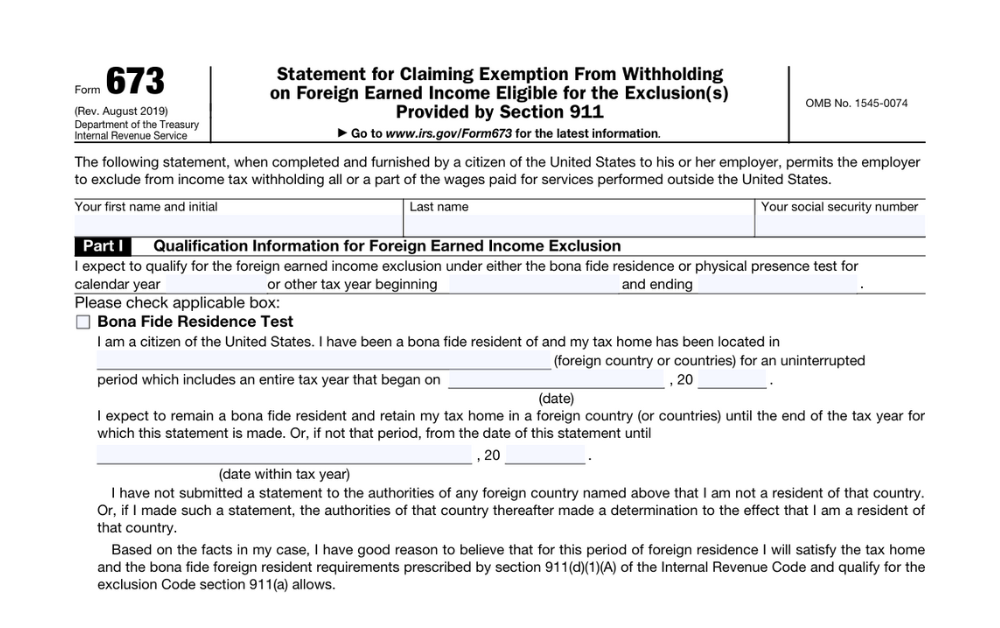

The international made income exemptions, often referred to as the Sec. 911 exclusions, omit tax on earnings earned from functioning abroad.

The Ultimate Guide To Feie Calculator

The tax obligation advantage excludes the income from tax at bottom tax rates. Previously, the exclusions "came off the top" decreasing earnings subject to tax at the top tax rates.

These exclusions do not exempt the salaries from US taxation however merely offer a tax reduction. Keep in mind that a bachelor working abroad for every one of 2025 that earned about $145,000 without any other earnings will have taxable revenue reduced to no - successfully the same answer as being "tax obligation complimentary." The exemptions are computed every day.